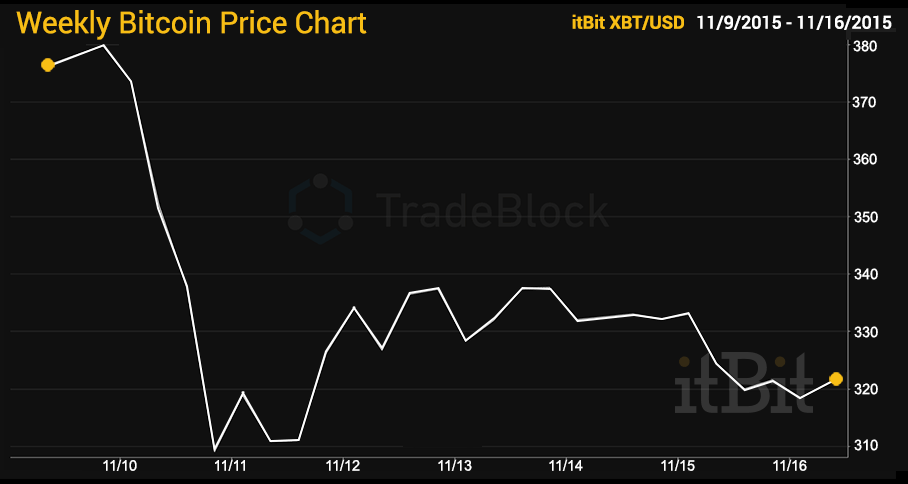

Bitcoin prices continued to fall back to Earth last week. The price dropped 16% with buying interest thinner and wider than previous weeks. This may have been a result of an influx of supply hitting the market due to the recent USMS auction. Buyers may continue to sit on the sidelines this week as they search for a viable re-entry point amidst the recent price drop.

VIEW OUR LATEST BITCOIN OTC MARKET DATA FOR OCTOBER 2015 [INFOGRAPHIC]

Source: tradeblock.com

Bitcoin Price Recap

Speculation within the bitcoin community points to downward pressure from added supply released by the recent USMS auction as a driver behind the price decline. Since the time auction bids were due on November 5th, the price of bitcoin has dropped 21%. A few trading venues even broke below the $300 mark last week, hitting a low of $294 before moving higher.

OUR LATEST BITCOIN TRADING RESEARCH DELIVERED TO YOUR INBOX! SUBSCRIBE TO ITBIT BLOG TODAY

Bitcoin by the Numbers

Bitcoin Trading Week Ahead

The bitcoin market could trade sideways for a majority of this week. There is a severe lack of demand as both buyers and sellers search for signs of price stability to make their next move. This week, traders can find short-term support at $315 with resistance at $325.

Best Bits from Last Week

- Wired: Everyone Says Bitcoin is Back. But It Never Really Left

- Engadget: Microsoft wants to make Bitcoin easier for banks

- Econotimes: Taiwan FSC Clears Air On Bitcoin Status Read

- CNBC: Banks Could Use Bitcoin Technology by Next Year 2016

Trade on itBit’s OTC Agency Trading Desk and Receive $50

Trading over 100 bitcoins? Use itBit’s OTC desk and receive $50 in bitcoin upon completing your first trade!

Personalized Trading Support | Low Fees | Same-Day Settlement

*All data and references are current as of 9:00AM EST on 11/16/2015.